CASEpeer, a case management platform for plaintiffs’ attorneys, is today launching an integration with the legal accounting software company Soluno that will provide its users access to a full suite of cost and trust accounting tools.

“Our goal was to have the integration between the two platforms be very seamless,” CASEpeer CEO Gabriela Cubeiro said during a demonstration that she and Soluno cofounder Alan Tuback recently gave me.

While many of her customers use QuickBooks, Cubeiro said, she had been looking for an accounting product that would more tightly integrate with CASEpeer and that would provide more powerful functions for tracking and managing client trust accounts.

“Client trust tracking is critical for PI attorneys, and many are not compliant using Quickbooks,” Cubeiro said. “Since the very first time I demoed Soluno, I knew I wanted to build an integration so CASEpeer clients could benefit from all it has to offer.”

Launched in 2017 and based in Canada, Soluno is full-featured, cloud-based accounting and billing software designed for legal professionals. Its accounting features include general ledger and trust accounting, financial statements, and an array of more than 70 financial reports.

Before launching Soluno, cofounder Tuback was with LexisNexis, where he led business operations for all products in LexisNexis Canada’s practice management and client development product lines. His cofounder Doug Dagworthy was also with LexisNexis, where he was lead architect and development manager for PCLaw.

CASEpeer, founded in 2015 and headquartered in Newport Beach, Calif., is cloud-based case management software for personal injury firms.

Deep Integration

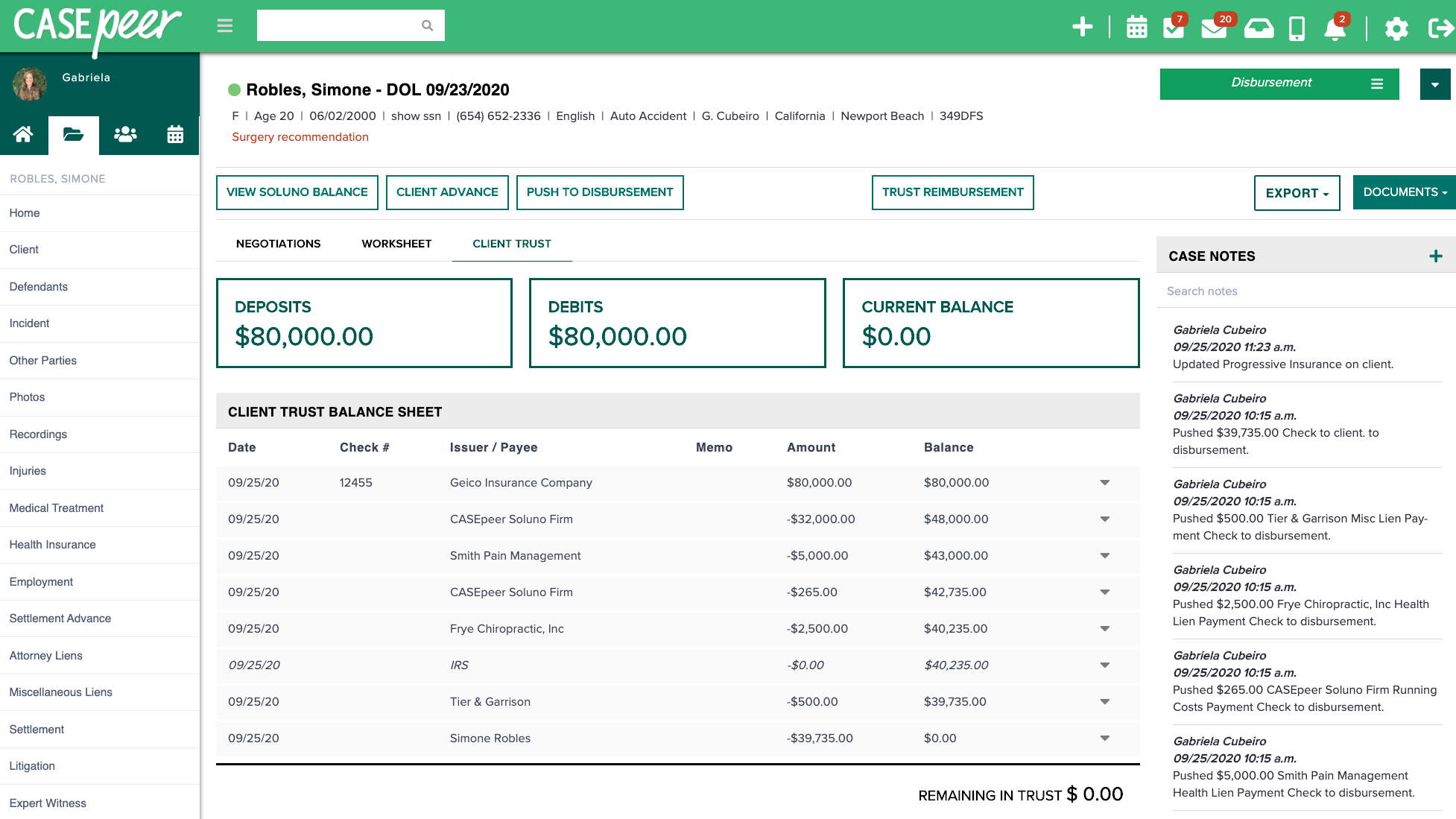

The integration between the two products is tight, allowing information entered and actions taken within CASEpeer to flow into Soluno and vice versa. From within CASEpeer, users can create Soluno cases, queue check requests, and prepare trust disbursements.

When a user opens a new case in CASEpeer, a corresponding case file will also be created in Soluno, and that Soluno reflects the correct attorney assigned to the case and the office from which the attorney works.

Costs entered in any matter in CASEpeer aggregate to a cost-management screen, where a “Send to Soluno” button transfers the information.

While accounting for costs is somewhat straightforward, Cubeiro said that what she is most excited about is client trust tracking. The CASEpeer and Soluno platforms are always talking to each other, so a firm’s accountant can add a settlement deposit in CASEpeer and immediately click over into Soluno and log the deposit.

Within CASEpeer, the lien negotiator on the case can track all final amounts and trust disbursements and accept them as ready for disbursement.

In Soluno, the user can open the file manager to see the information for a matter and can generate a client ledger report showing the full activity and balances for the client.

As a check-and-balance, if a user in CASEpeer tries to write a disbursement check for more than is available in the trust account, Soluno will block it.

Separate Subscription

To take advantage of this integration, CASEpeer customers will need a separate subscription to Soluno. However, not every CASEpeer user requires the additional subscription.

Only those who need to access Soluno require a subscription, which in most firms might be the managing partner, an accountant, or administrative staff.

The various integration buttons that allow information to be transmitted to Soluno appear in CASEpeer only when the integration is activated. Customers who do not have the integration will not see those buttons.

Robert Ambrogi Blog

Robert Ambrogi Blog