The legal services company LegalZoom today announced a $500 million secondary investment led by Francisco Partners and GPI Capital, with Franklin Templeton Investments and Neuberger Berman Investment Advisers also participating.

Existing investors will retain meaningful stakes in the company, the announcement said. Global private equity firm Permira will remain the largest shareholder. Bryant Stibel will retain its entire ownership stake and Kleiner Perkins and Institutional Venture Partners (IVP) will retain the majority of their ownership stakes. IVP and Kleiner Perkins invested in LegalZoom in 2011; the Permira funds and Bryant Stibel invested in 2014.

Reporter Dan Primack at Axios says that the deal values LegalZoom at over $2 billion. Permira acquired its control stake with a investment of $200 million, he says, “so this appears to be at least a 5x appreciation.”

“Delivering valuable solutions that naturally evolve into deeper relationships with customers has resulted in a rare combination of healthy profitability and accelerating revenue growth,” LegalZoom CEO John Suh said in the announcement. “We’re excited to partner with an impressive set of new growth equity investors that will support our efforts to democratize law.”

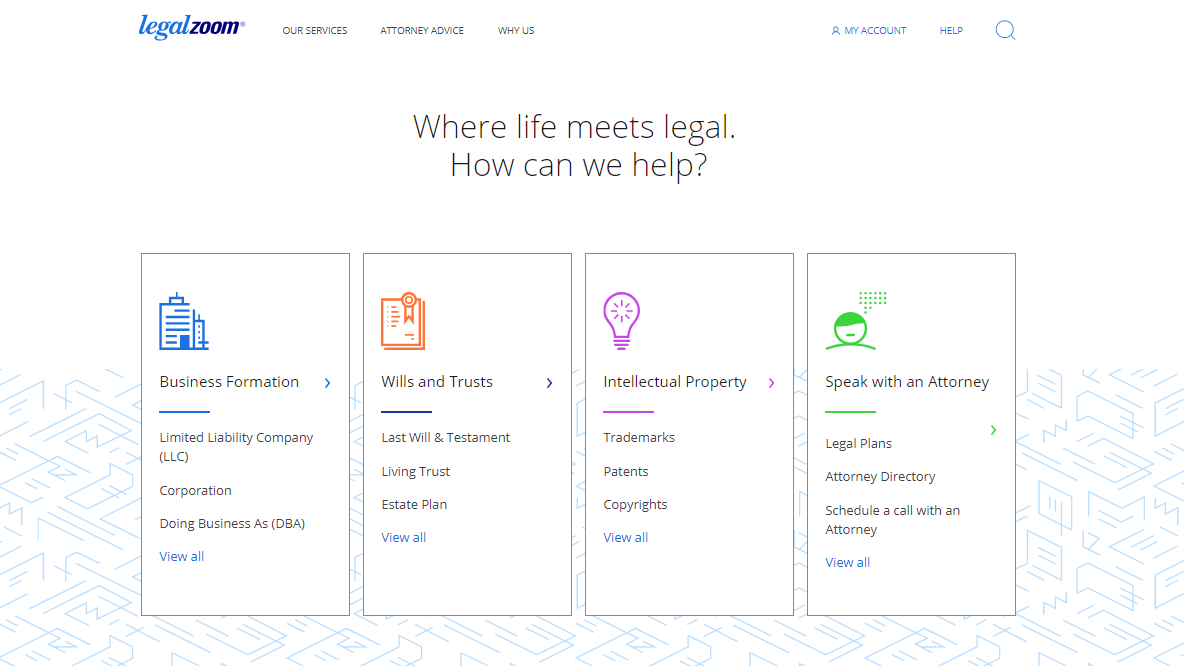

In recent years, LegalZoom has expanded into the United Kingdom and grown subscriptions to more than half its U.S. revenue.

“We are delighted to partner with the team at LegalZoom, which has combined preeminence of brand and leadership in online legal services with an attractive business model,” said Neil Tolaney, head of consumer internet investing at Francisco Partners, in the announcement. “We share LegalZoom’s commitment and mission-driven approach to providing business owners and families with a robust product offering, leveraging the power of a passionate team of ‘Zoomers’ and an extensive network of attorneys.”

Robert Ambrogi Blog

Robert Ambrogi Blog