Leana Fisher was an associate in the financial restructuring practice group at Morgan, Lewis & Bockius the first time a partner asked her to draft a reorganization plan for a debtor. Uncertain of what to do, she dove into PACER in search of examples and burned the midnight oil cobbling together a plan. When she presented it to the partner the next morning, he questioned why she had included various provisions that were inapplicable to their client. She had no good answer.

Flash forward many years, and Fisher is now the director in charge of a product she believes will help other lawyers avoid a similar fate. The second in the new Lexis Practice Advisor series, this one focuses on financial restructuring and bankruptcy. It is being officially released today.

The idea behind the Lexis Practice Advisor series is to provide transactional lawyers with one-stop shopping for information and tools they need for their practices. The first in the series was focused on business law. This financial restructurings module is the second. The third, due out this summer, will be a California jurisdictional module.

In developing this module, Lexis executives sought to address three “pain points” they identified through customer interviews, Suzanne Petren-Moritz, vice president and managing director of Lexis Practice Advisor, told me. The goal of the product was to help attorneys:

- Simplify the routine aspects of what they do, without requiring them to reinvent the wheel for every new matter.

- Get up to speed quickly when dealing with new transaction types.

- Provide starting points for drafting documents.

Fisher and Petren-Moritz gave me a tour of the new module earlier this week. I do not have my own log-in so I have seen it only as they presented it to me.

When you sign-in, you arrive at a landing page from which you can either browse or search for a topic. The page also includes a small “what’s new” pane showing what is new, added or changed within the module.

The browse menu is organized by topics and subtopics relevant to financial restructuring, such as “Plan of Reorganization and Disclosure Statement,” “Exit Financing” and “Asset Purchase Agreements.” This is notable, Fisher says, because other bankruptcy resources are often organized by Bankruptcy Code section, making it harder to find what is needed for the matter at hand.

Once you select your topic, you come to a page with seven tabs across the top. These tabs form the heart of Practice Advisor:

- Overview. A descriptive overview of the topic and discussion of key considerations.

- Practical Guidance. Practice guides written by actual practitioners in the field that describe how to handle the matter and that provide practice notes. Contributors come from some of the top firms in the field, Fisher proudly notes, including Cravath, Swaine & Moore; Simpson Thacher & Bartlett; Milbank, Tweed, Hadley & McCloy; and Fried, Frank, Harris, Shriver & Jacobson.

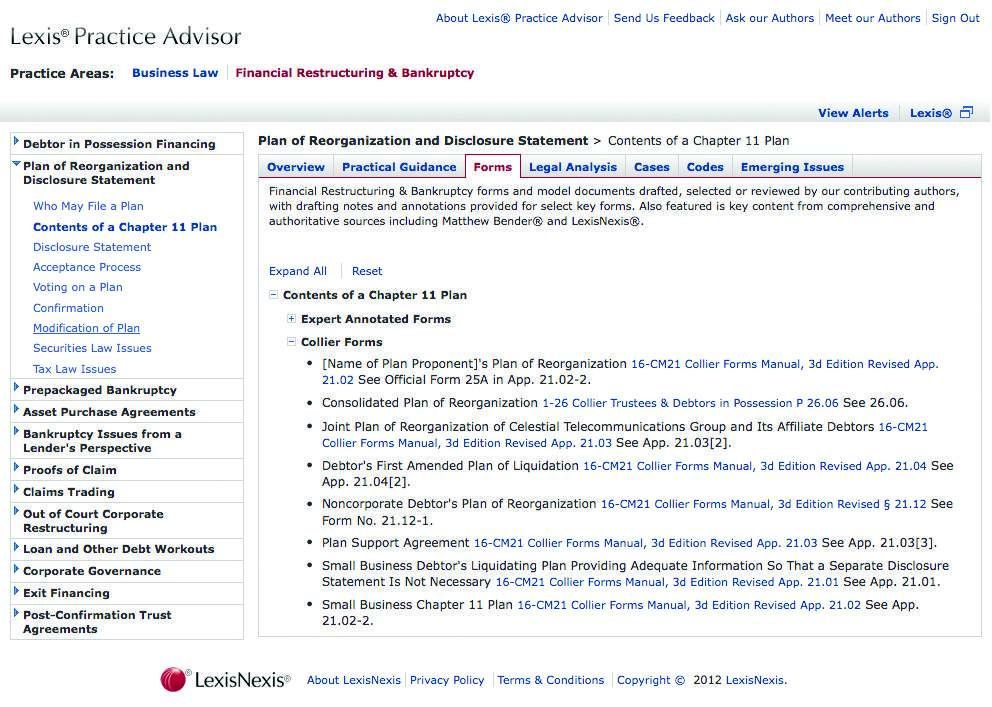

- Forms. A collection of forms and model documents with annotations by experts in the field. Some of these forms come from practitioners, some from actual filings and some from the treatise, Collier on Bankruptcy. Forms are annotated with drafting notes, offering guidance on the use of particular provisions. This section also includes briefs, pleadings and motions.

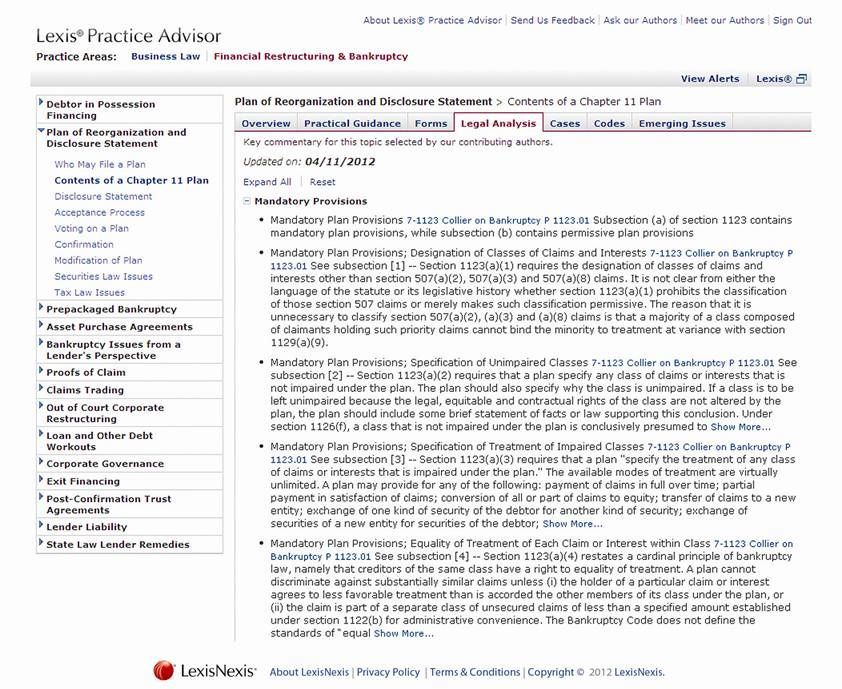

- Legal Analysis. Commentary on the topic selected from key treatises, including Collier. “We’ve scoured Collier for all the relevant material,” Fisher says.

- Cases. Key cases selected based on their relevance to the topic and organized by topic. For example, within the topic “Contents of a Chapter 11 Plan,” cases are organized under subtopics such as “Mandatory Provisions” and “Classification of Claims and Interests.”

- Codes. Sections of the Bankruptcy Code and rules, selected based on their relevance to the topic.

- Emerging Issues. Highlights and analysis of important, emerging legal issues to consider, selected based on their relevance to the topic.

Notice how many times I wrote “selected” in the bullet points above. It is important to understand that, while the Practice Advisor promises to cover a topic thoroughly and in-depth, it does not provide a complete library of every reference you might want.

Instead, the editors have compiled what they judge to be the most relevant to the topic. Thus, you get selections of topics and forms from Colliers, but not the full Colliers. You get sections of the Bankruptcy Code, but not the full code.

If you want to go deeper, you will need to jump into the full Lexis database. Throughout Practice Advisor, it provides links that will take you to the pertinent sections of Lexis.com, if you want to go there.

But Fisher says that, as a practice-focused tool, Practice Advisor has the key information a lawyer would want. The cases and code sections selected for inclusion are presented in full, with all headnotes and hyperlinks (links that function within the module). Forms are presented in full and can be downloaded, printed and emailed.

“There will be no dead ends,” she said. “If it is relevant, it is included.”

This Practice Advisor module for financial restructuring and bankruptcy is sold on a flat-fee, annual basis. The price is $120 a month, per practice-area attorney. Note that that is not a per-subscriber price – if the firm’s financial restructuring practice area has 20 attorneys, it is charged for 20 attorneys, no matter how many of them want to use this. Of course, Lexis will consider pricing discounts for large practice groups or firms with other Lexis accounts.

It’s been at least two decades since I last handled a bankruptcy matter. That said, I remember well feeling the uncertainty Leana Fisher must have felt as a young associate drafting her first reorganization plan. Based on my tour yesterday, this looks to be a product that can help relieve that uncertainty, pulling together key cases, laws and treatises and combining them with practical guidance and commentary from actual practitioners.

Robert Ambrogi Blog

Robert Ambrogi Blog